One Of The Best Info About How To Find Out If I Filed My Taxes

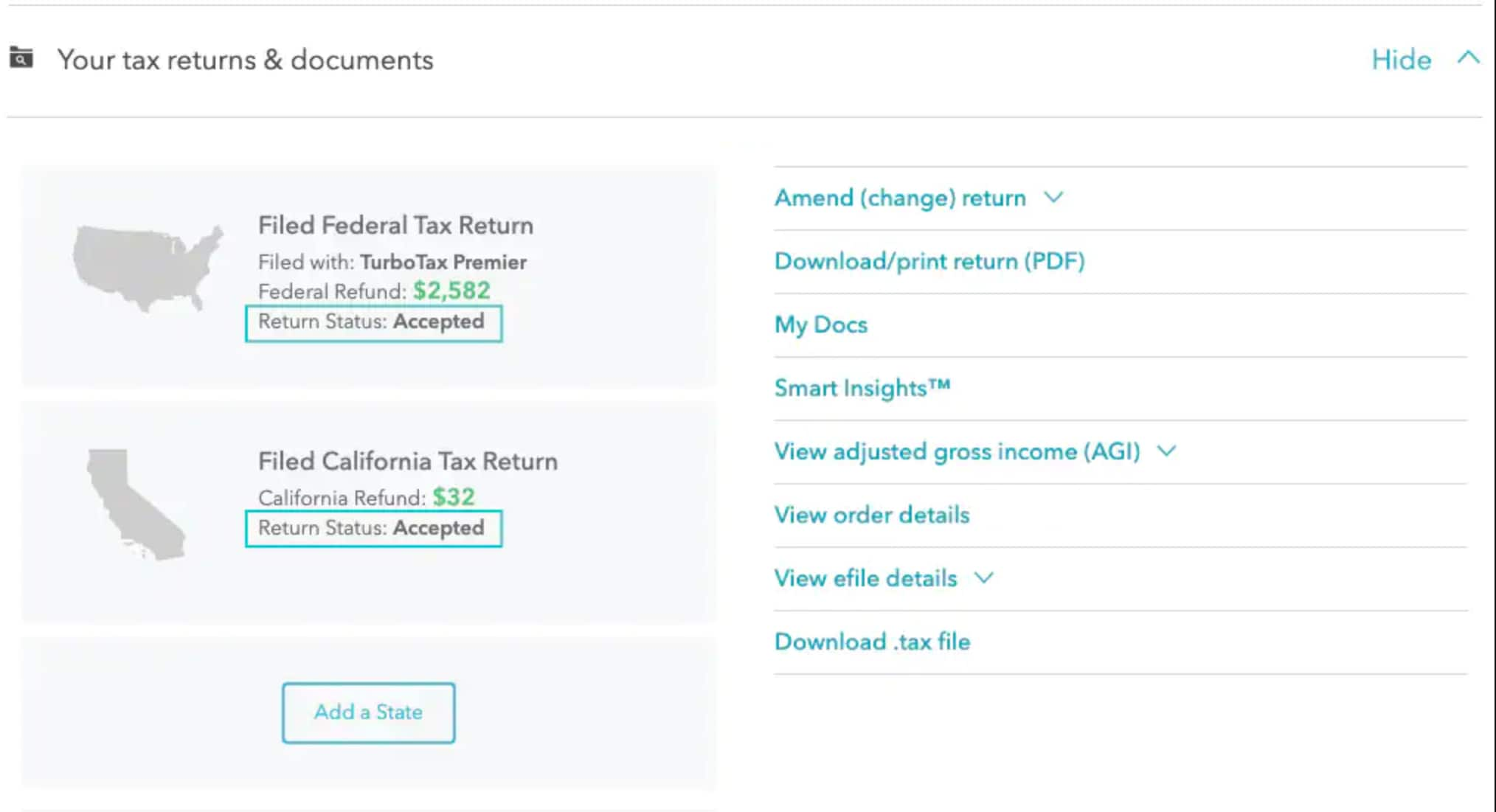

Viewing your irs account information.

How to find out if i filed my taxes. Their social security number or individual taxpayer identification number. Using the irs where’s my refund tool. Find out if your tax return was submitted.

During your tax year, it earns $100,000 with $60,000 of deductible business expenses. This is an irs hotline number that you can call to quickly check tax filing compliance. It’s quick, easy and secure.

How long does it take to get a tax refund. Review the amount you owe, balance for each tax year and payment history. Fax the irs agent the 8821 form.

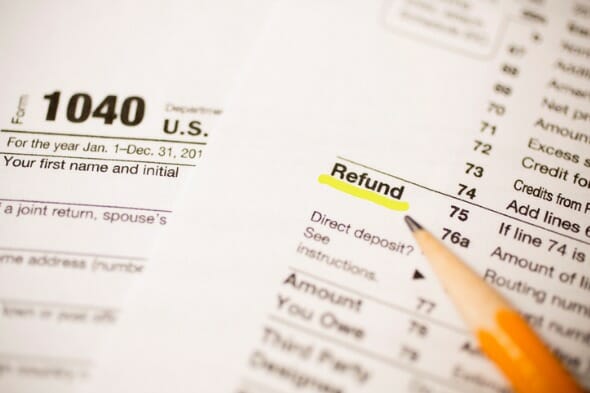

You may request your 2020 wage and tax transcript free from the irs (or full tax return at a charge). According to the irs, most taxpayers should receive their tax refunds within 21 days if they filed electronically and chose to get their. Those who file a paper return can check.

The irs agent can hold while you send. The last day to file taxes for individual federal income tax returns is april 15, or as late as april 18 in the event tax day falls on a saturday, sunday or official holiday. Your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct tax.

To use the tool, taxpayers will need: They can use get transcript online on irs.gov to view, print or download a copy of. Quickest is online, next is.

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)