Heartwarming Tips About How To Afford More House

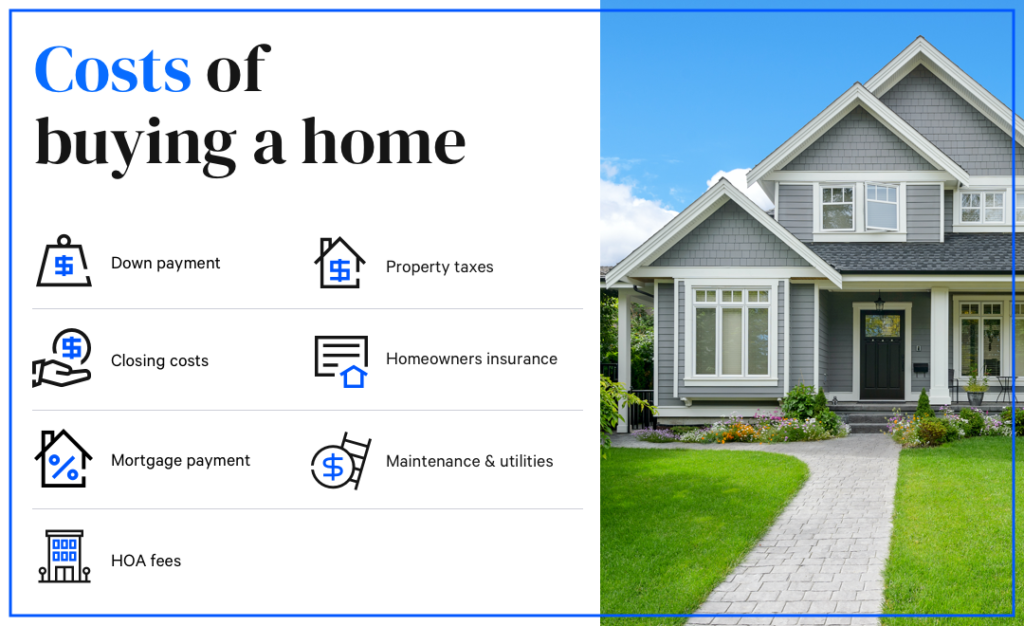

However, you must consider several factors such as the downpayment, loan terms and interest rates, debt.

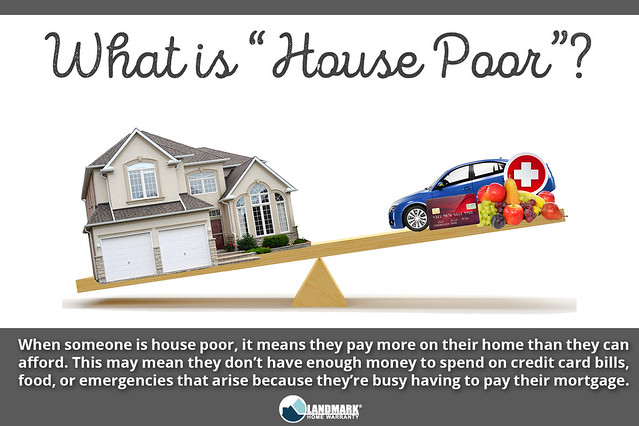

How to afford more house. Payments you make for loans or other debt, but not living expenses like. Let’s cut to the chase. Ultimately, your income, debts, assets, and liabilities determine how much house you can.

To calculate how much house you can afford, use the 25% rule: Don’t try to buy a house just for the price tag. This is the total amount of money earned for the year before taxes and other deductions.

How much house can i. How can i afford more house? There are many things that factor into how much money you may be able to borrow, like your income, credit, size of down payment, as well as employment and residence.

Ways to buy a new, expensive house here are some of them: To calculate ‘how much house can i afford,’ a good rule of thumb is using the 28%/36% rule, which states that you shouldn’t spend more than 28% of your gross monthly income on home. This page will calculate the most expensive house you can afford based on your income and other factors.

If you don’t have the money, you shouldn’t buy a house. Total income before taxes for you and your household members. You can usually find the amount on your w2.

Here are three options to help you afford a house: Go one step further by applying some of the advanced filters for a more precise picture of what you can afford for a future residence by including the costs associated with homeownership. Multiply your monthly gross income by 28% and boom you have your.